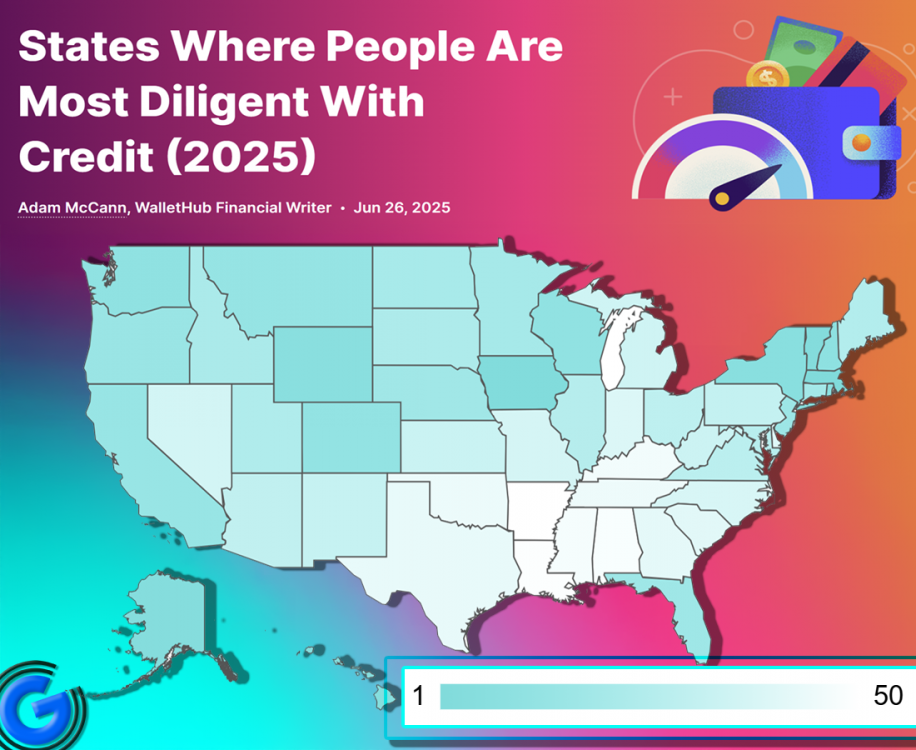

Tennessee - Volunteer State residents are among the least vigilant in managing credit, ranking 45th out of 50 states in a recent WalletHub study that assessed credit diligence across the U.S. The personal finance website’s latest report analyzed how proactive Americans are in managing their credit health, using six key indicators including collections activity, missed payments, bankruptcies, foreclosures, and disputes of credit report errors.

Summery: The new WalletHub study shows that Tennessee ranks 45th out of 50 states when it comes to managing credit, making it one of the least credit-diligent states in the country. The report looked at things like missed payments, accounts in collections, bankruptcies, and foreclosures. Tennessee ranked poorly in most areas, including 48th in active bankruptcies, but did better in credit report disputes, coming in 15th. Experts say Tennesseans need to be more careful with their credit by checking reports for mistakes, paying bills on time, and keeping debt low—especially with rising interest rates. Scroll down for more numbers and information.

Tennessee - Despite national efforts to boost financial literacy, Tennesseans are lagging behind in several key categories:

- 41st in percentage of customers with accounts in collections

- 40th in customers with missed payments

- 48th in active bankruptcies

- 42nd in foreclosures

- One bright spot: Tennessee ranked 15th in the percentage of residents who’ve filed credit report disputes in the last two quarters

Overall, the state was labeled the sixth least credit-diligent in the nation.

Financial experts urge Tennesseans to take a more hands-on approach to credit management. “Monitoring credit reports for errors, staying current on payments, and keeping debt levels low are critical steps,” said a local financial advisor based in Nashville. “Especially with interest rates rising, a solid credit profile can make a real difference.”

Massachusetts claimed the top spot for most diligent credit behavior, according to WalletHub analyst Chip Lupo, due to its low rates of missed payments, collections, and foreclosures.

The full report underscores the importance of financial discipline, especially as economic uncertainty continues to pressure household budgets across the country.

For tips on improving credit health or disputing credit report errors, WalletHub’s full state-by-state breakdown is available HERE. Let me know if you’d like a summary of best credit practices to include.