RUTHERFORD COUNTY, TN - More news has emerged regarding possible inaccuracies in property record reporting at the Rutherford County Assessor of Property office. WGNS first learned of potential errors this past June, following reports that some parcels across the county had incorrect square footage data recorded from one year to the next.

As complaints against the office continued to mount, examples of misreporting under the leadership of Assessor Rob Mitchell began to make their way to the Rutherford County Ethics Committee. In July, the ethics committee had hundreds of pages of alleged wrongdoings that were discussed and opened for public comment... That was Richard Kincaide. Evidently, he filed the initial complaint that prompted a deeper investigation into the matter.

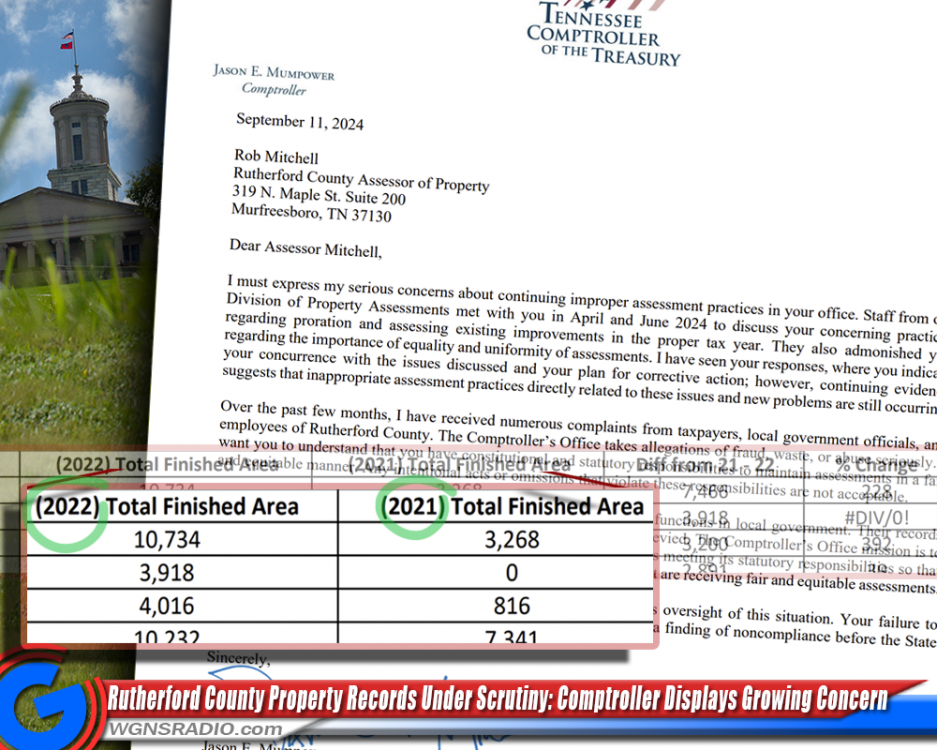

Jason Mumpower, the Comptroller of the Treasury for the State of Tennessee, reportedly visited with Mitchell in both April and June to discuss the importance of assessing properties in Rutherford County equally in a fair manner. But the comptroller suggested that despite attempts to correct behaviors, inappropriate assessments continued.

Earlier this year, Mitchell appeared before the ethics committee and defended his office stating... Mumpower said on Wednesday in a letter that new new problems are still occurring.

According to documents submitted to the ethics committee, a long list of properties appeared to increase in square footage for unknown reasons. One property went from 3,268 square feet of finished space in 2021 to 10,734 square feet in 2022. The same address jumped up in size by another +1,792 square feet in 2024. Also on the list of parcels that may have questionable errors was a residential structure that recorded a growth of +1,807 square feet.

County Mayor Joe Carr's home was one of the many residential properties that somehow grew in size, despite a lack of construction... Page after page of evidence was presented to the ethics committee, highlighting inaccuracies in property reporting. The extensive list included over 350 properties that mysteriously grew by 300 to 696 square feet in size between 2021 and 2022. There were at least 20 pages that documented around 80 parcel accounts per page, that showed properties with square footage increases of 1% to 228%... Keep in mind that the more finished square footage a home has - the more a homeowner usually has to pay in property taxes.

Oddly enough, a handful of locations named in the list of examples showed a decrease in square footage. Some properties shrunk by as much as 2,524 square feet (Scroll down for access to documents).

In a September 11, 2024 letter to the Assessor, the Comptroller of the Treasury expressed serious concerns about ongoing improper assessment practices in Mitchell's office. Despite two previous meetings to address issues related to proration, assessing improvements in the correct tax year, and ensuring uniformity in assessments, Mumpower noted that these issues have persisted. He mentioned receiving numerous complaints from taxpayers, local officials, and county employees about the situation, emphasizing the importance of fair and equitable assessments as part of Mitchell’s constitutional and statutory duties. Mumpower warned that failure to correct these problems could lead to a finding of noncompliance before the State Board of Equalization, adding that the Division of Property Assessments will increase its oversight.

To make matters more concerning to some homeowners with alleged magical square footage increases, the county mayor suggested that refunds for over-payment can only go back two years. Carr said he overpaid a total of nine times – or nine years....

The situation continues to unfold and Rutherford County District Attorney General Jennings Jones has been updated with a copy of the letter that was mailed to Mitchell on Wednesday, September 11, 2024.

- PDF Documents Released by Rutherford Co. HERE

- If you have trouble visiting the above link, CLICK HERE

- CLICK HERE for 9/11/2024 Comptroller of Treasury Letter

WGNS will continue to follow this story.

DISCLAIMER: All suspects are presumed innocent until proven guilty in a court of law. The arrest records or information about an arrest that are published or reported on NewsRadio WGNS and www.WGNSradio.com are not an indication of guilt or evidence that an actual crime has been committed.