The rental vacancy rate — or the proportion of rental homes that are vacant in a given area — is an important economic indicator because it signals the balance between supply and demand for rental housing. High vacancy rates indicate an ample supply of rental properties, fostering competition among landlords and placing downward pressure on rent prices, which can lead to improved affordability for renters. Conversely, low vacancy rates indicate a shortage of rental units, driving up prices as demand outstrips supply.

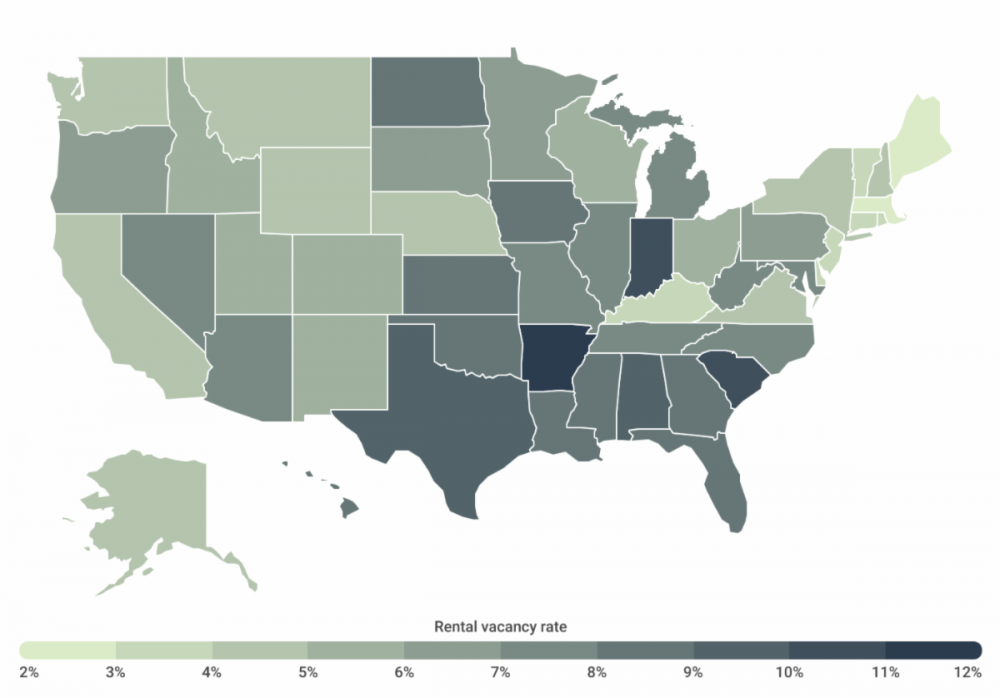

To determine the locations with the highest rental vacancy rates, researchers calculated the percentage of rental homes that were vacant in 2023, then ranked states accordingly.

Highlights and key stats for Tennessee:

-

Despite recent increases in construction activity, which have nudged the national rental vacancy rate up to its current level of 6.6% as of the first quarter of 2024, it is still below the historical average of 7.3%.

-

The relatively low rental vacancy rate and high rent prices together have caused renters to designate increasingly large portions of their income to rent. Over half of renter households now spend 30% or more of their income on rent — a level deemed unaffordable by the Department of Housing and Urban Development (HUD).

-

In 2023, the rental vacancy rate in Tennessee was at 7.8%, with a median rent of $1,433 per month.

-

Out of all 50 states, Tennessee had the 15th highest rental vacancy rate in 2023.

Since the Great Recession, the rental vacancy rate in the United States largely declined, coinciding with a slowdown in construction activity. This trend persisted for over a decade, reaching a low of 5.6% in 2021 — a level not observed since the 1980s. Due to the relative shortage of rental units, market rates surged by astonishing double-digit percentages during 2021 and 2022, creating financial havoc for prospective renters. Despite recent increases in construction activity, which have nudged the rental vacancy rate up to its current level of 6.6% as of the first quarter of 2024, it is still below the historical average of 7.3%. Additionally, rental prices remain considerably higher than pre-pandemic levels, exacerbating affordability challenges for many individuals seeking housing.

The result is that many renters have no choice but to designate increasingly large portions of their income to rent. As of the latest American Community Survey released in late 2023, over half of renter households now spend at least 30% or more of their income on rent—a level deemed unaffordable by the Department of Housing and Urban Development (HUD).

The consequences of unaffordable housing extend beyond mere financial strain, impacting individuals’ ability to allocate resources toward essential needs such as food, healthcare, transportation, and child care. Moreover, it impedes their capacity to save for pivotal life events, including debt reduction, retirement planning, and family aspirations. The large percentage of Americans spending significant portions of their paycheck on rent helps explain delays in parenthood and increases in the average age of first-time homebuyers.