(Tennessee) Researchers calculated each state’s per capita disposable income in 2021, adjusted for cost-of-living differences, and ranked them accordingly. The analysis found that post-tax income in Tennessee—after adjusting for the state’s below-average cost of living—was $54,576 per capita in 2021, compared to $55,671 nationally.

Overall - The economy has been a roller coaster for consumers over the last two and a half years, and the ride isn’t slowing down yet. As COVID-19 and its ripple effects have continued to shape the economy, U.S. households have navigated both prosperity and struggles. But, in which state do Americans have the most cash to spend on things outside of utility bills, food and housing expenses?

Americans who call Connecticut home, evidently have the most cash to spend on non-necessity ‘stuff,’ or the most cash to save after they pay their bills and taxes. Even though the cost of living is 3.4% higher than the national average in Connecticut, the per-capita income post-taxes is $66,740, which is $12,164 higher than what Tennessee residents see.

Tennesseans are ranked 24th in the nation for having the most disposable cash to spend or save, depending on what you do with your income. The per-capita income of Tennessee residents after taxes equals a little more than $54-thousand annually. When you factor-in the cost of living in the Volunteer State, which is 7.9% lower than the national average, it means Tennesseans have extra income to spend or save each month!

When looking at Rutherford County households, it appears that residents are doing well. In 2021, the Rutherford County Chamber of Commerce reported the average household income was $82,341 annually. That same year, Rutherford County was listed as the 8th fastest growing midsize city in the United States with 20-new residents per day. Smart Asset rated Murfreesboro as “America’s Top Boomtown in 2020.”

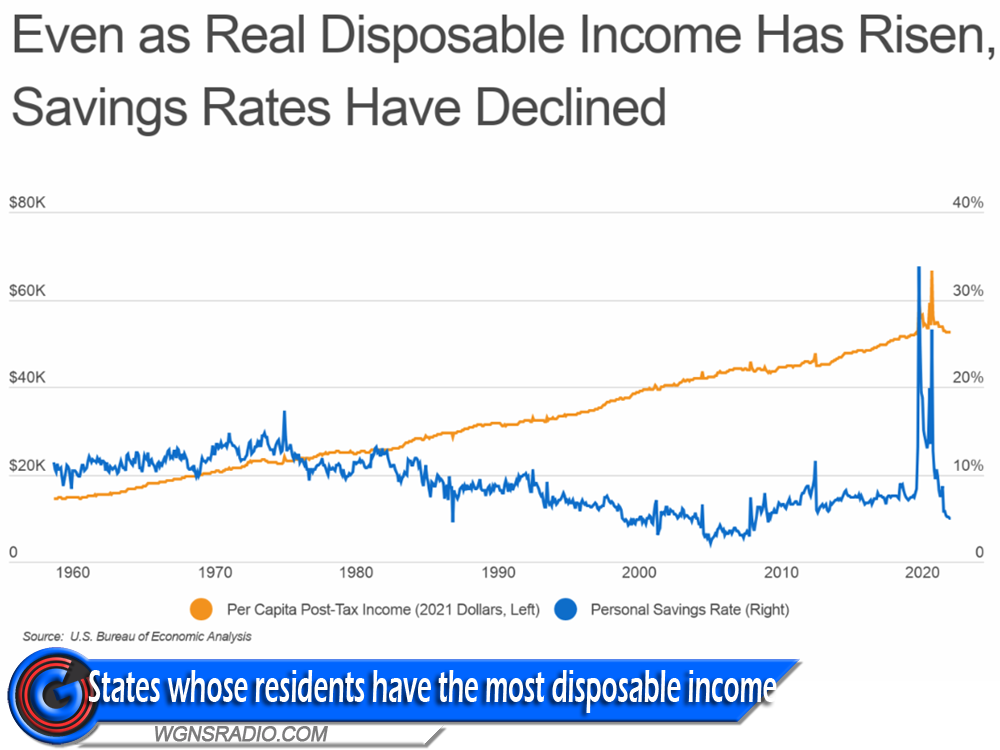

More on this study: In the early weeks and months of the COVID-19 pandemic, experts feared that widespread shutdowns would devastate households economically. While March and April 2020 did bring brief spikes in unemployment, the economy overall fared better than expected early in the pandemic. Expansive government relief programs gave a boost to household finances, and because people spent less during lockdowns, the personal savings rate—calculated as the percentage of disposable income that people save—increased to record heights. Over the course of 2020 and 2021, low interest rates for borrowing and rising wages in a tight labor market continued to make it easier to save, keeping the rate elevated.

The rise and persistence of inflation more recently has reversed that trend. Year-over-year increases in the Consumer Price Index have exceeded 5% in every month since May 2021 and topped 8% in each of the last six months. With everything from housing to energy to groceries becoming more expensive, money that consumers had previously been setting aside is increasingly going toward essential spending.

These economic headwinds have sent the household personal savings rate back down to pre-COVID levels. The savings rate peaked at 33.8% early in the pandemic but had fallen to just 5% as of July 2022—less than half the rate of the previous July and the lowest level since the Great Recession. Today’s figures are more in line with recent history: despite steadily rising real disposable income over time—where disposable income is defined as total personal income less any personal taxes paid—personal savings rates have fallen from 10% to 15% in the mid-1970s to between around 4% and 8% in more recent decades.

Low savings rates can have a positive effect on economic activity because they signal that consumers are spending on goods and services. But in today’s environment, with high prices and rising interest rates, low savings could expose more households to financial difficulties. If the U.S. economy enters a recession and unemployment rates increase, households with depleted savings may struggle with essential spending.

As a result, having more disposable income is important for positioning families to pay for necessary expenses and weather hardships when they arise. On this count, residents in certain parts of the country will be better off than others. Without taking cost of living into account, states in the South tend to have the lowest per capita incomes on both a pre- and post-tax basis. In contrast, most of the states where disposable incomes are highest are coastal locations, which tend to have higher concentrations of well-educated workers and well-paying industries. But these states also often have higher cost of living. As a result, some of the states with the most disposable income, after adjusting for differences in living costs, are in fact found in low-cost parts of the central U.S.

Back to Tennessee - The data used in this analysis is from the U.S. Bureau of Economic Analysis. To determine the states whose residents have the most cash to spend, researchers at Upgraded Points calculated the per capita disposable income by state in 2021, adjusted for cost-of-living differences. For the purpose of this analysis, disposable income is defined as total personal income less any personal taxes paid.

Here is a summary of the data for Tennessee:

- Per capita post-tax income (adjusted):$54,576

- Per capita post-tax income:$50,292

- Per capita pre-tax income:$54,873

- Per capita taxes paid:$4,581

- Cost of living (compared to average):-7.9%

For reference, here are the statistics for the entire United States:

- Per capita post-tax income (adjusted):$55,671

- Per capita post-tax income:$55,671

- Per capita pre-tax income:$63,444

- Per capita taxes paid:$7,773

- Cost of living (compared to average):N/A

For more information, a detailed methodology, and complete results, you can find the original report on Upgraded Points’s website: https://upgradedpoints.com/finance/states-with-the-most-cash-to-spend-or-save/

Additional WGNS News Headlines:

- Trick or Treat on the Downtown Murfreesboro Square

- Murfreesboro Police Aim to Catch Suspect in Check Forgery Case

- UPDATE: Wildfires in Warren County, TN

- Families of Crash Victims to Honor Loved Ones at Rock Springs Middle School

- Middle Tennessee Electric in the Lineman Rodeo

- 326 Driving and Drug Related Offenses in Rutherford Co.

- Arrests Made in Murfreesboro Kidnapping, Extortion and Robbery Case

- UPDATE: Murfreesboro Skatepark in Planning and Design Phase

- Suspect Charged with Wife's Murder Scheduled for Court in November

- Drug Take-Back Event on Saturday

- Ongoing Scams in Rutherford and Bedford Counties