RUTHERFORD COUNTY, TN - The Rutherford County Assessor's Office has publicly acknowledged the impact of the state-calculated appraisal ratio on the tax base and how the numbers could hinder the financial well-being of local residents. The State of Tennessee conducts these appraisal ratio studies to determine, among other items, the amount of tax relief available to qualifying applicants.

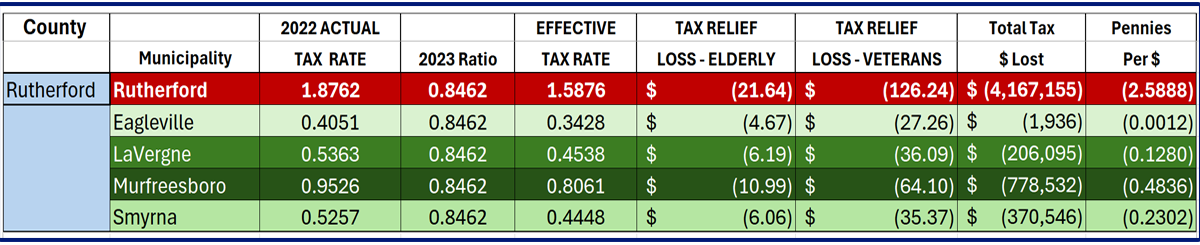

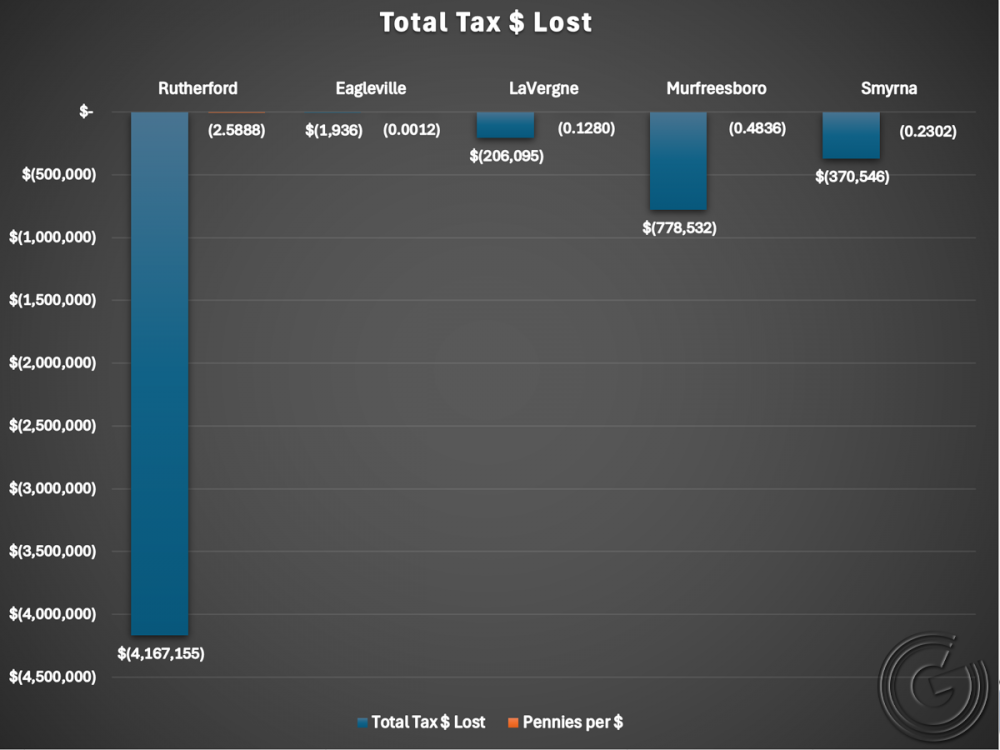

Assessor of Property Rob Mitchell stated in an email to WGNS, “The state calculated appraisal ratio not only reduces the tax base for the county, which shifts the tax burden onto residential property owners, but it also causes a reduction in the property tax relief payments to our low income elderly citizens and disabled veterans.” According to numbers released by Mitchell, the total tax relief loss adds up to $4.1-million in Rutherford County.

Appraisal ratio studies are executed between the reappraisal years in all 95-counties. These studies measure the relationship between appraised value and market value of real property.

Mitchell has released a chart that he says, “...clearly illustrates the negative repercussions of the state's appraisal ratio.” The assessor suggested the visual will bring transparency and possibly allow residents to better understand the complexities of the situation.

Assessing personnel utilize ratios to identify appraisal procedure issues, update property values between revaluation years, adjust sale prices, develop depreciation schedules, and test reappraisal results. The Comptroller of the Treasury and the State Board of Equalization use ratios to determine not only tax relief, but to equalize assessed values, and adjust tax rates. Local education agencies use ratios to equalize assessed values for education funding, while municipally owned utilities use them to equalize tax rates for payments in lieu of taxes.