How and where people live saw a drastic transformation due to the COVID-19 pandemic. Following the initial lockdowns around the country aimed at slowing the virus's spread, society reopened with a large emphasis on remote work and social distancing which led many to relocate away from city centers. Although some individuals migrated out of densely populated urban areas early on, with many relocating to more spacious and affordable Sun Belt states, a considerable number of people ended up moving to local suburban regions within the same metropolitan areas.

Typical migration patterns changed rapidly, wreaking havoc in the rental housing market. Many people leaving big cities desired to buy their own homes. However, the combination of historically low interest rates, millennials aging into the stage of life where homeownership is more appealing, and low housing supply created fierce competition in the real estate market, pricing out potential homebuyers. With a greater number of individuals remaining in the rental market, demand for rental units surged while rental vacancies dwindled.

The U.S. rental vacancy rate—or the measure of rental homes that are vacant in a given area—is facing a long-term decline. After a steady increase in the rental vacancy rate from the 80s through early 2000s, in part the result of increasing production of new housing units, the housing market crash and resulting Great Recession brought a dramatic reduction in housing investment and a rapid decline in rental vacancies. And although the pandemic produced an initial increase in rental vacancies as many rushed to purchase homes, the effect was short-lived and the downward trend continued through 2022.

The rental vacancy rate is an important economic indicator because it signals the balance between supply and demand for rental homes. When the rate is relatively high, it indicates an abundance of available rental properties, which typically places a downward pressure on rent prices. But with the rental vacancy rate being the lowest it’s been since the mid-80s, competition over available units is fierce and prices are historically high.

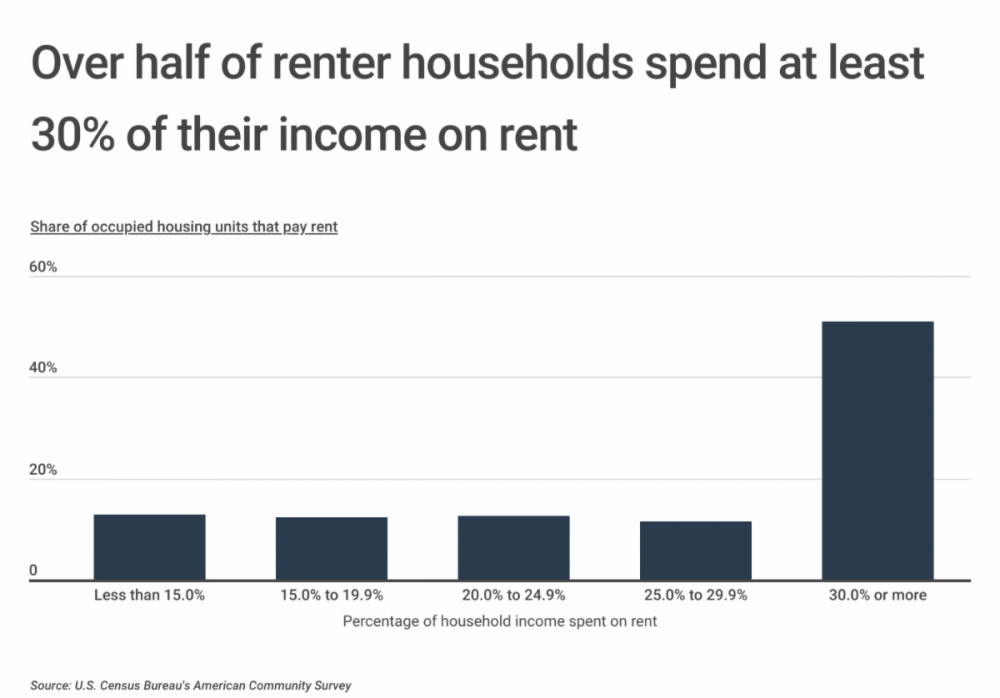

The result is that many renters have no choice but to designate more and more of their income to rent. In fact, over half of renter households are spending at least 30% or more of their income on rent, and according to the Department of Housing and Urban Development (HUD), spending more than 30% of gross income on rent is generally considered unaffordable.

The consequences of unaffordable housing include having less money for individuals to spend on critical needs like food, healthcare, transportation, and child care, as well as being unable to save for critical life events like reducing debt and planning for retirement and family goals. The large percentage of Americans spending significant portions of their paycheck on rent helps explain the delay in parenthood for many and an increase in the average age of first-time homebuyers from 33 in 2021 to 36 in 2022.

While the federal government is attempting to address the housing affordability issue by closing the housing supply shortfall broadly across the nation, the housing problem is affecting certain areas more than others. Locations with lower rental vacancy rates can indicate a dwindling supply of rental units and increased need for rental housing solutions. Western and northeastern states have the lowest rental vacancy rates in the country, with 13 out of 15 states with the lowest vacancy rates belonging to the West or Northeast—all with rental vacancy rates of 4.5% or lower.

Conversely, southern and midwestern states tend to have more vacancies. All 15 states with the highest rental vacancy rates are located in the South or Midwest. Similarly, at the metropolitan level, the South and Midwest are home to 14 of the top 15 highest rental vacancy rates for metros, with the Charleston-North Charleston, SC area leading the nation at 15.3%.

The data used in this analysis is from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. To determine the locations with the highest rental vacancy rates, researchers at Construction Coverage, a construction and home improvement website, calculated the percentage of rental homes that were unoccupied in Q1 2023. In the event of a tie, the location with the greater percentage of households in occupied housing units that rent was ranked higher.

The analysis found that 6.7% of rental homes in Tennessee were unoccupied during the study period, compared to 6.4% of rental homes nationally.

Here is a summary of the data for Tennessee:

- Rental vacancy rate: 6.7%

- Percentage of households that rent: 32.5%

- Median monthly rent: $1,237

- Percentage of renters that are cost-burdened: 48.1%

For reference, here are the statistics for the entire United States:

- Rental vacancy rate: 6.4%

- Percentage of households that rent: 34.6%

- Median monthly rent: $1,596

- Percentage of renters that are cost-burdened: 51.0%

For more information, a detailed methodology, and complete results, you can find the original report on Construction Coverage’s website: https://constructioncoverage.

Additional WGNS News Headlines:

- Proposed Rutherford County Property Tax Hike of More Than 15%

- Suspect in the Murder of a Smyrna Gas Station Clerk to Undergo a Mental Health Evaluation

- The Cost of Child Abuseis in the Billions Throughout Tennessee

- Rutherford County Sheriff’s Office Bike Patrol Proves Effective

- Shelbyville Police Investigating Non-ProfitDirector for Financial Exploitation of the Elderly

- Paid Summer Internships Connects MiddleTennessee Teens to Career Building Opportunities

- Status Hearing Scheduled for Suspect Accusedof Wrecking SUV into Smyrna High Athlete in St. Louis

- Murfreesboro Police Release Name ofPickup Truck Driver Killed in Accident this past Sunday

- 2023 Murfreesboro Murder Case Involvingthe Stabbing of a Roommate Bound Over to the Grand Jury